The CBI says the government should use tax incentives to improve the market for low carbon heating and other carbon-reduction measures in buildings.

In a new report, the business group calls for a change to VAT, business rates, and the structures and buildings allowance (SBA) requirements for energy efficiency materials and technologies. It says rates could be used to encourage businesses – particularly SMEs – to invest in onsite renewable generation and low-carbon heating systems. It also urges the Treasury to produce an overarching tax policy roadmap that has net-zero policies at its heart.

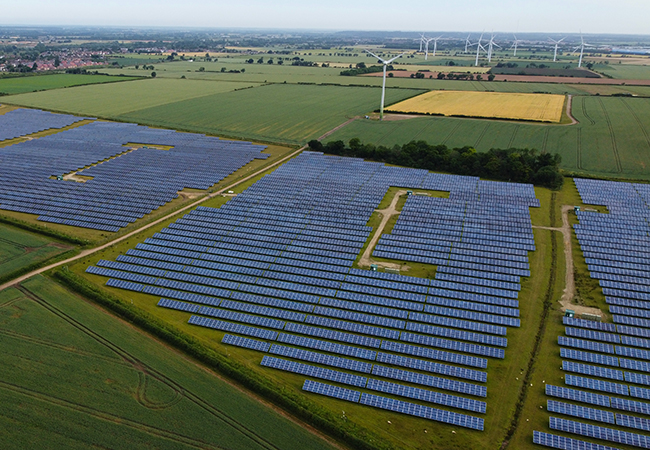

‘The high burden of business rates – a tax rate of close to 50% – often means that the costs associated with improving the property outweigh the benefits, and can make the investment commercially unviable,’ the CBI report explains. ‘Green technologies such as solar panels are included in the business rates calculation, which can be the tipping point of that investment not going ahead… which is out of kilter with the government’s net-zero ambitions.’

The government’s Heat and Buildings Strategy has been delayed, but is expected to announce a replacement for the Renewable Heat Incentive. In the meantime, the government has been criticised by the Public Accounts Committee and the BEIS Select Committee for having no coherent plan for delivering net-zero carbon emissions by 2050.